Order Flow

How we differ from retail traders teaching and using order flow

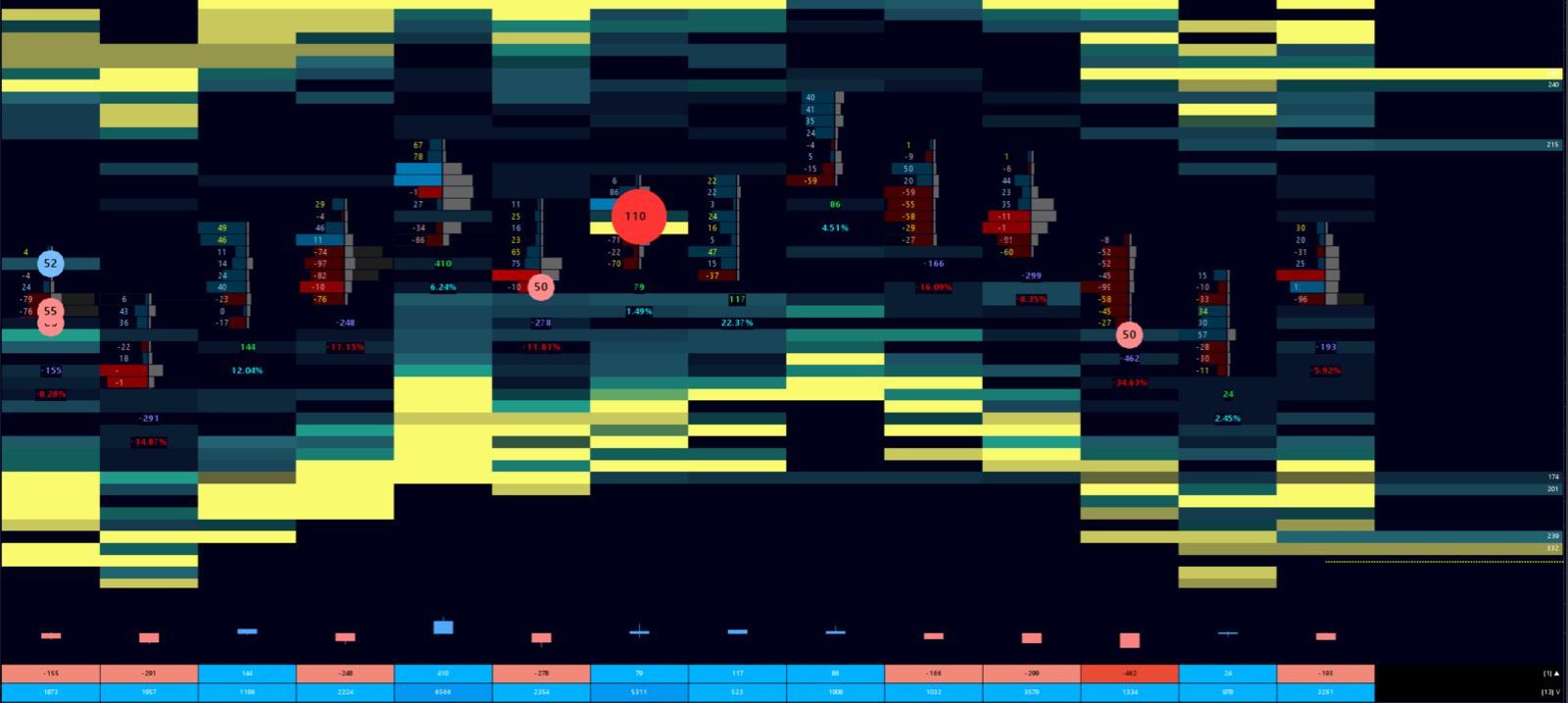

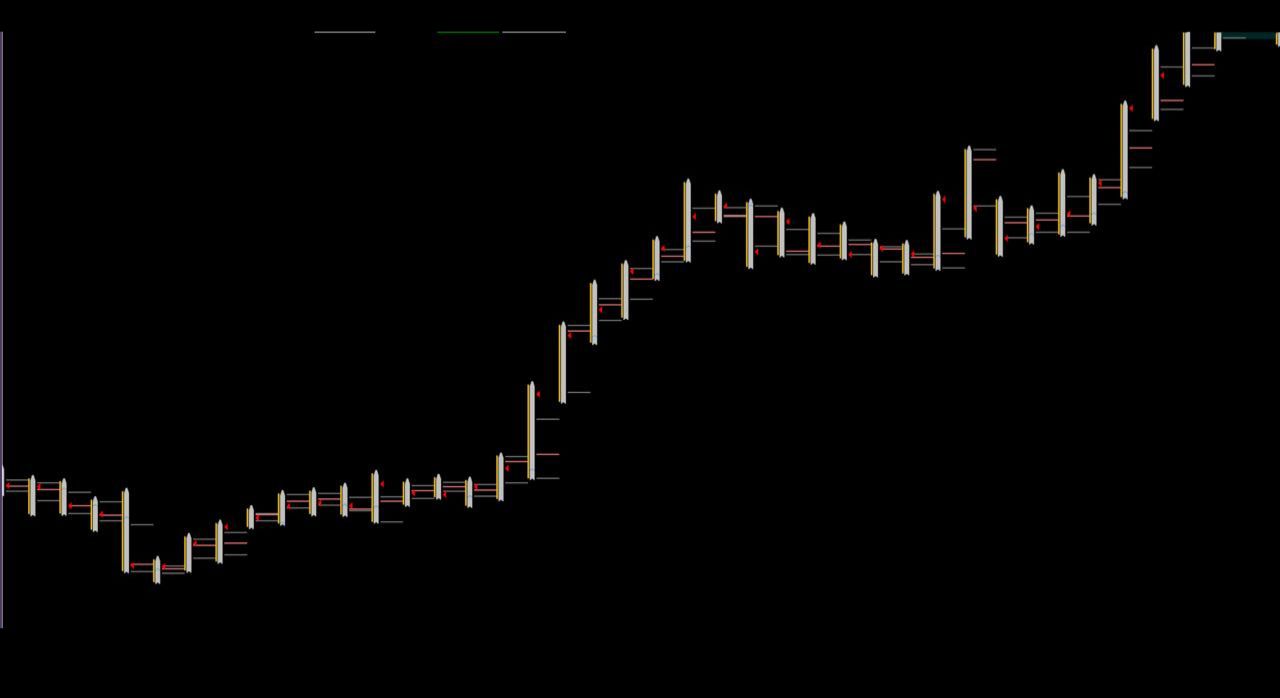

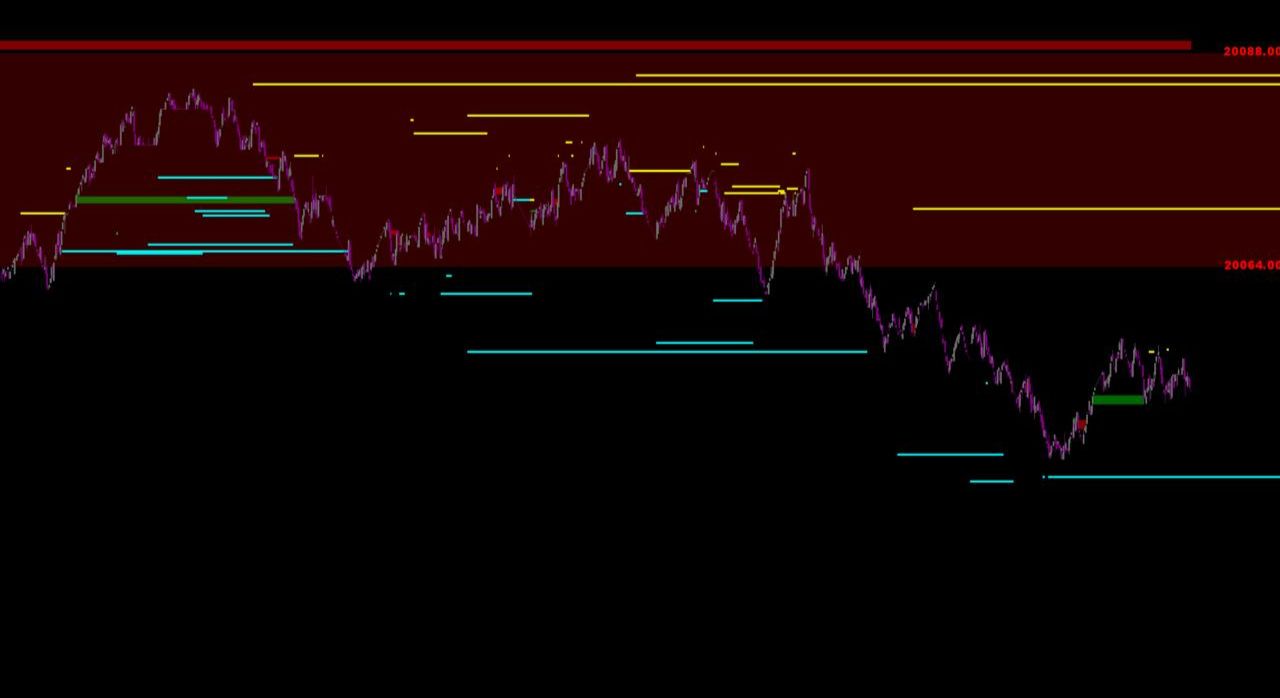

We don’t use the footprint charts widely used by retail traders, as we have a more precision-based system that is not laggy.

We use different charts that give us insights into the markets and are filtered differently. How we teach and interpret this filtered data is what makes all the difference.

We eliminate all the noise from market depth and focus solely on teaching and using crucial information from market data

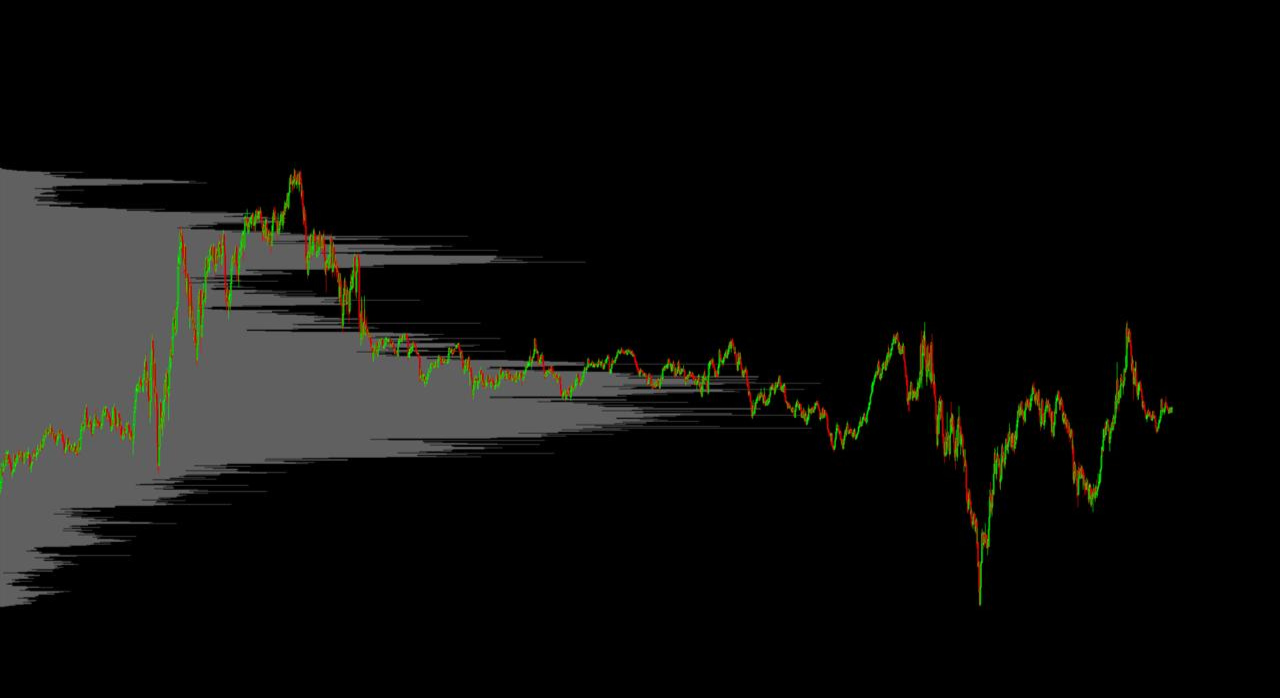

We don’t use these

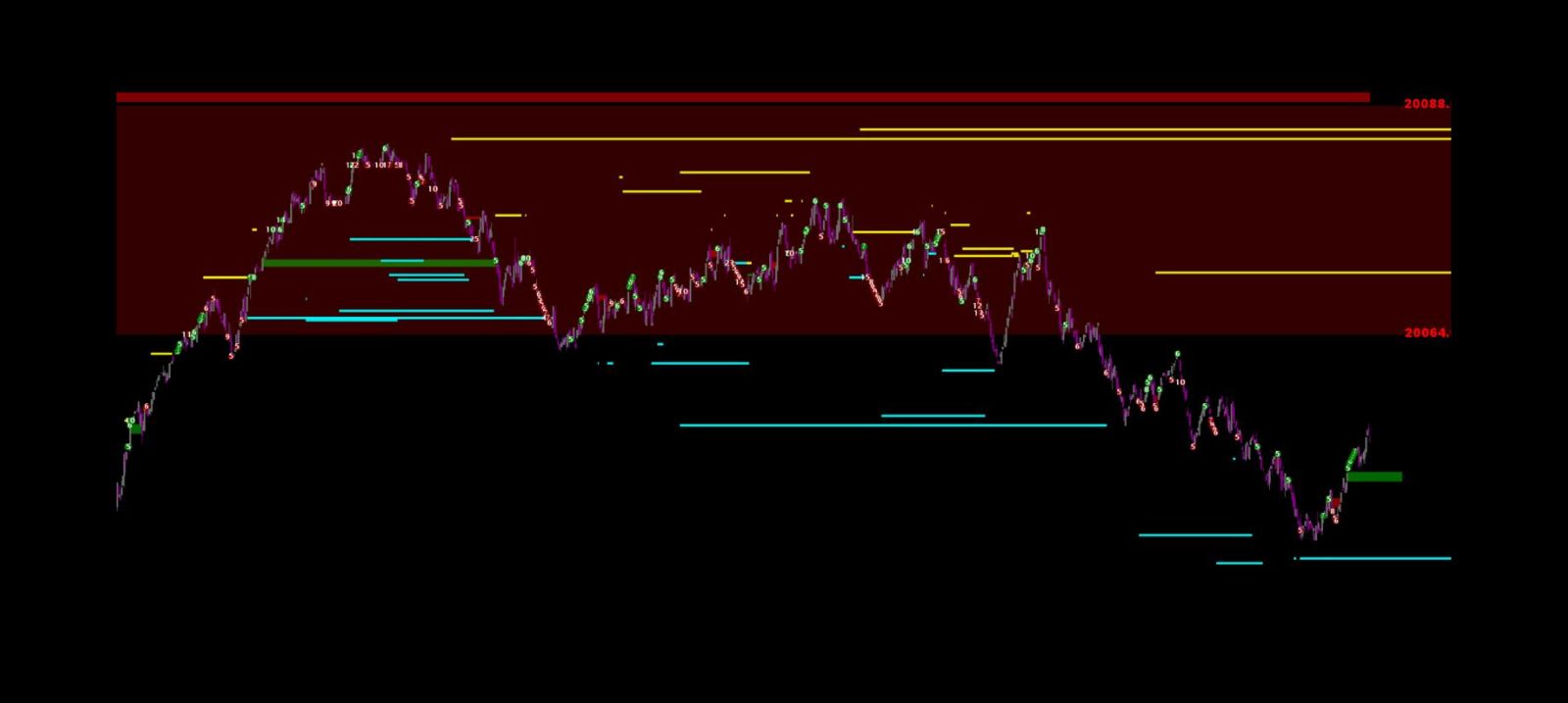

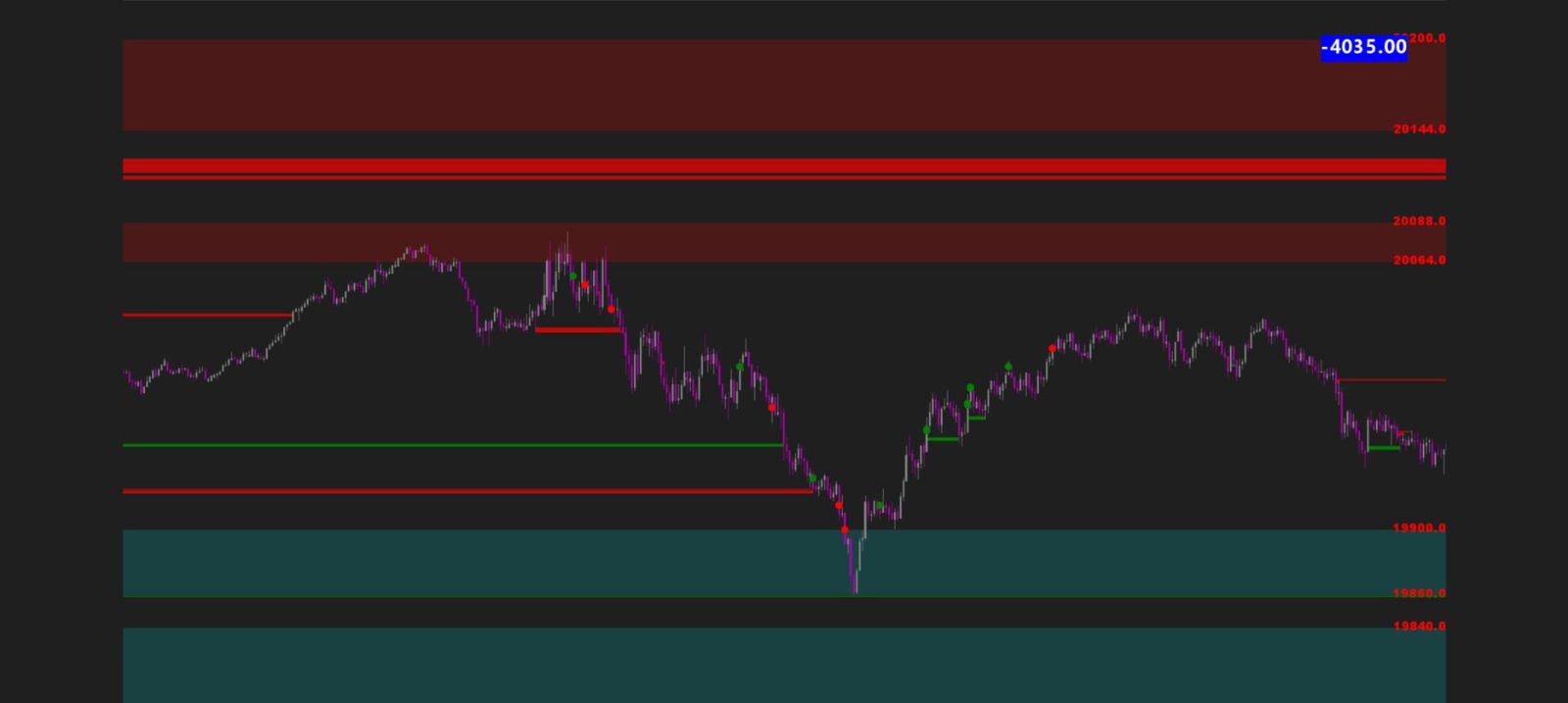

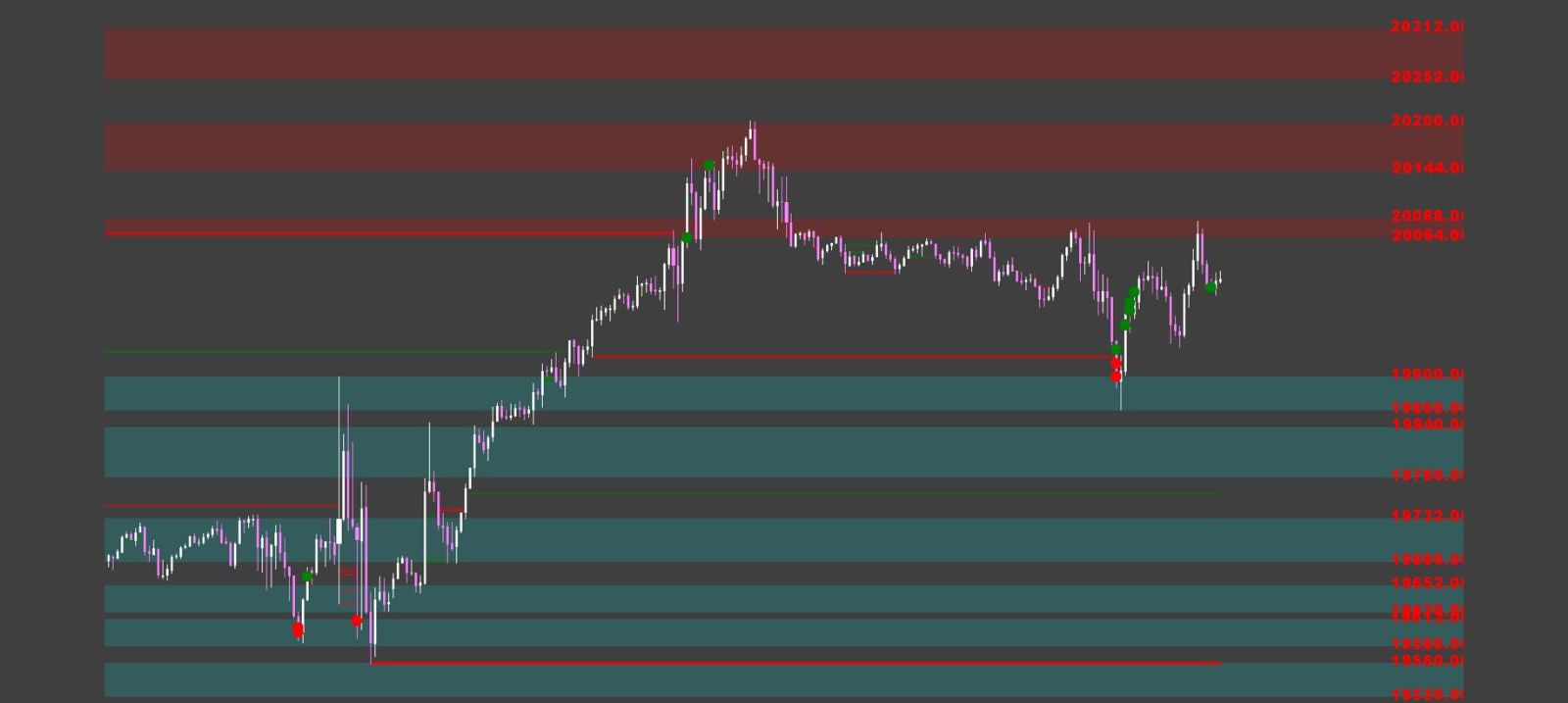

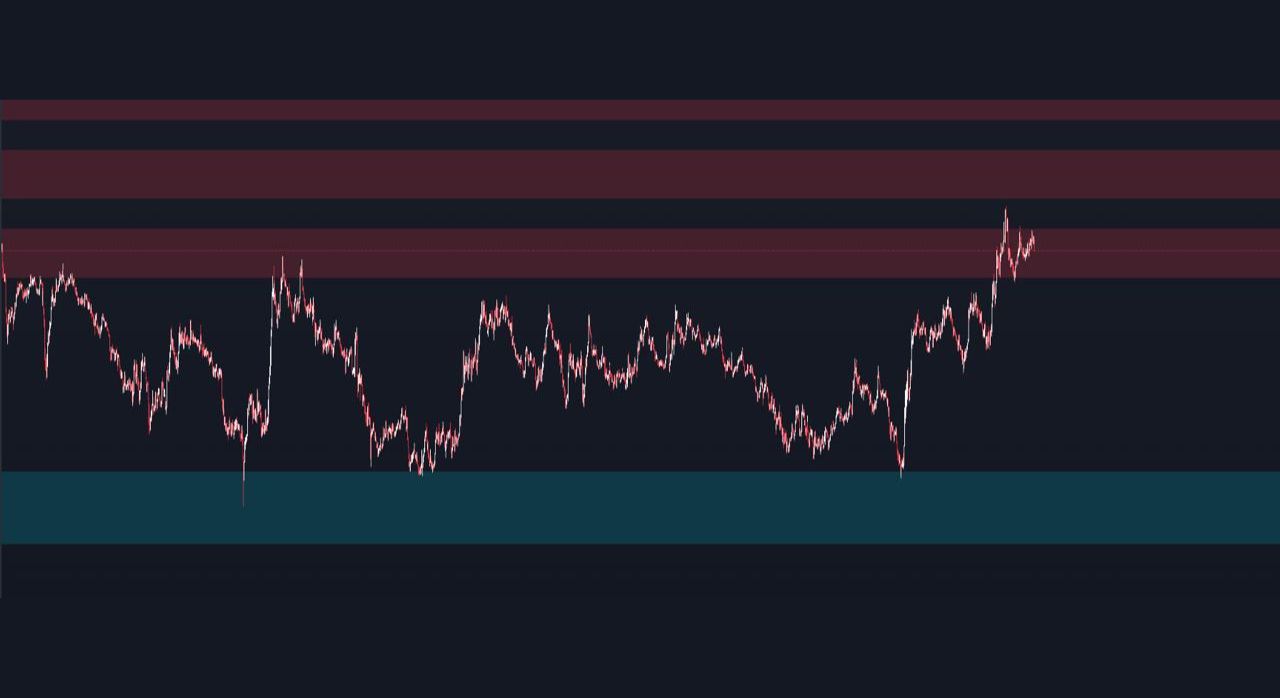

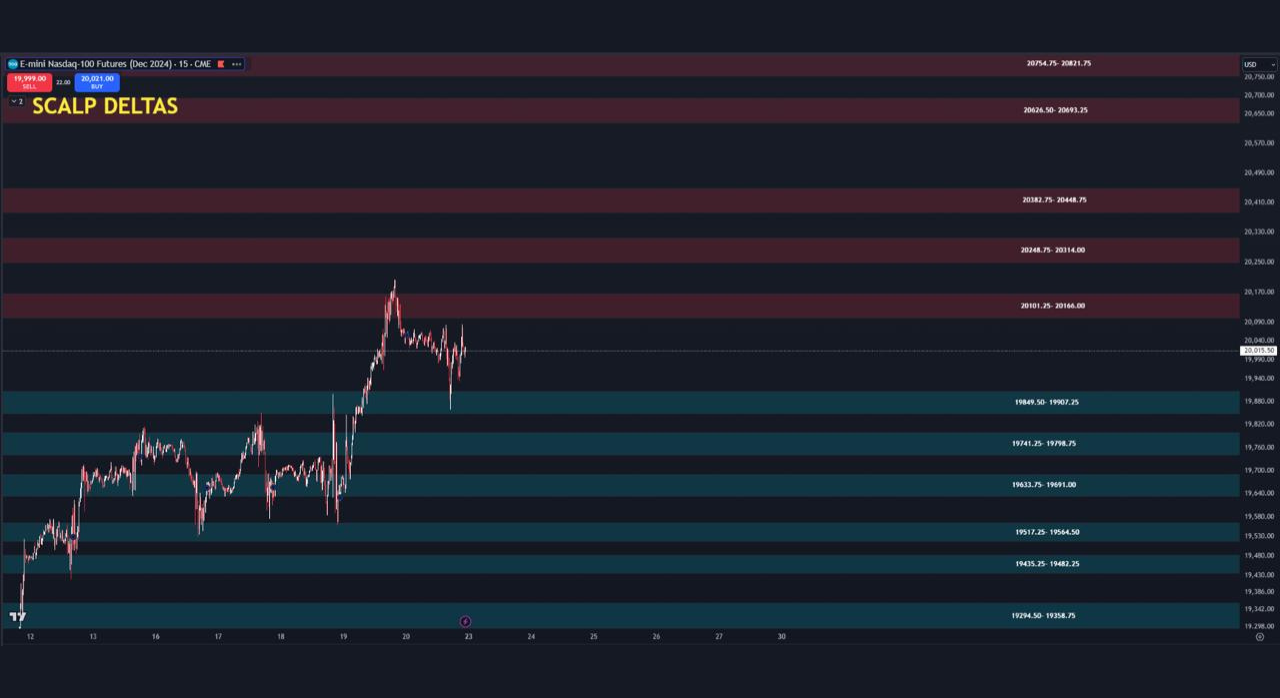

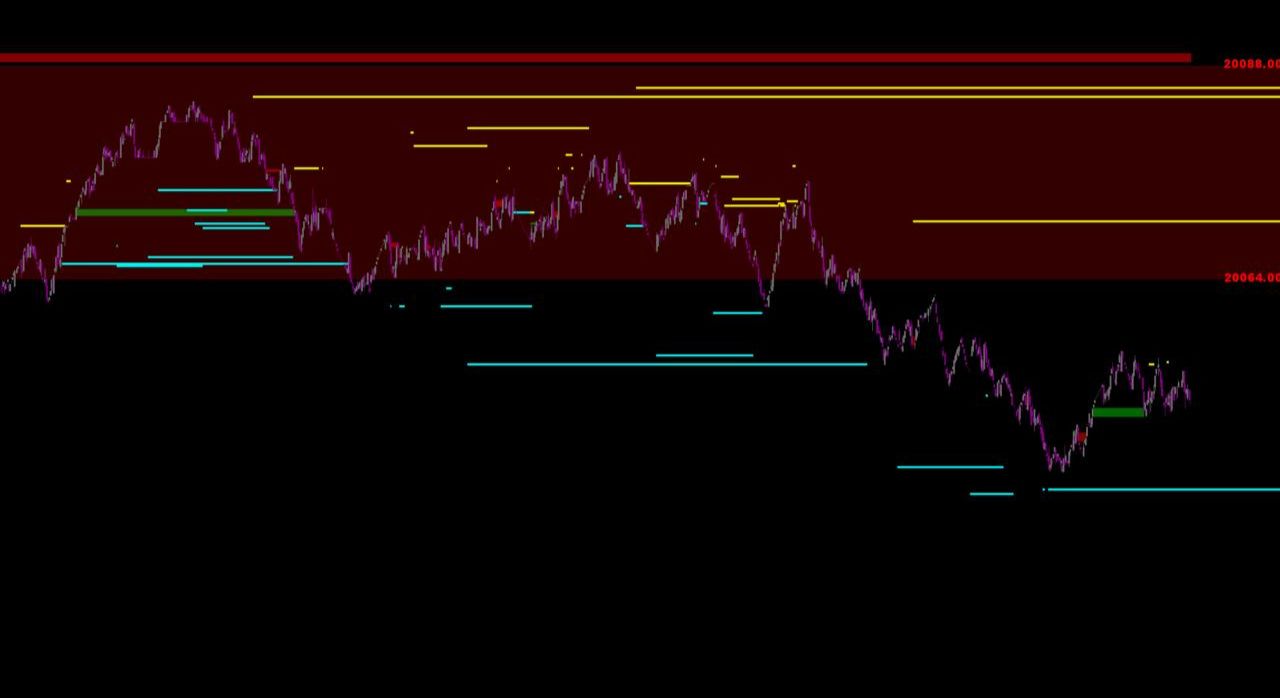

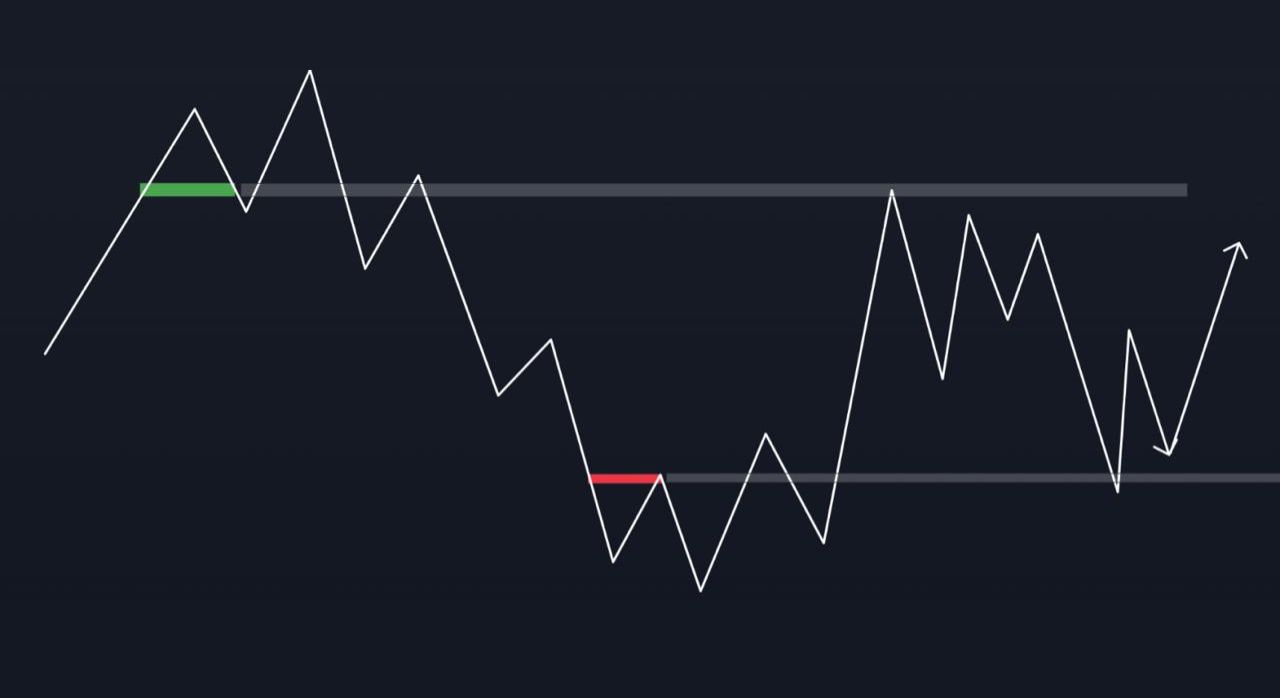

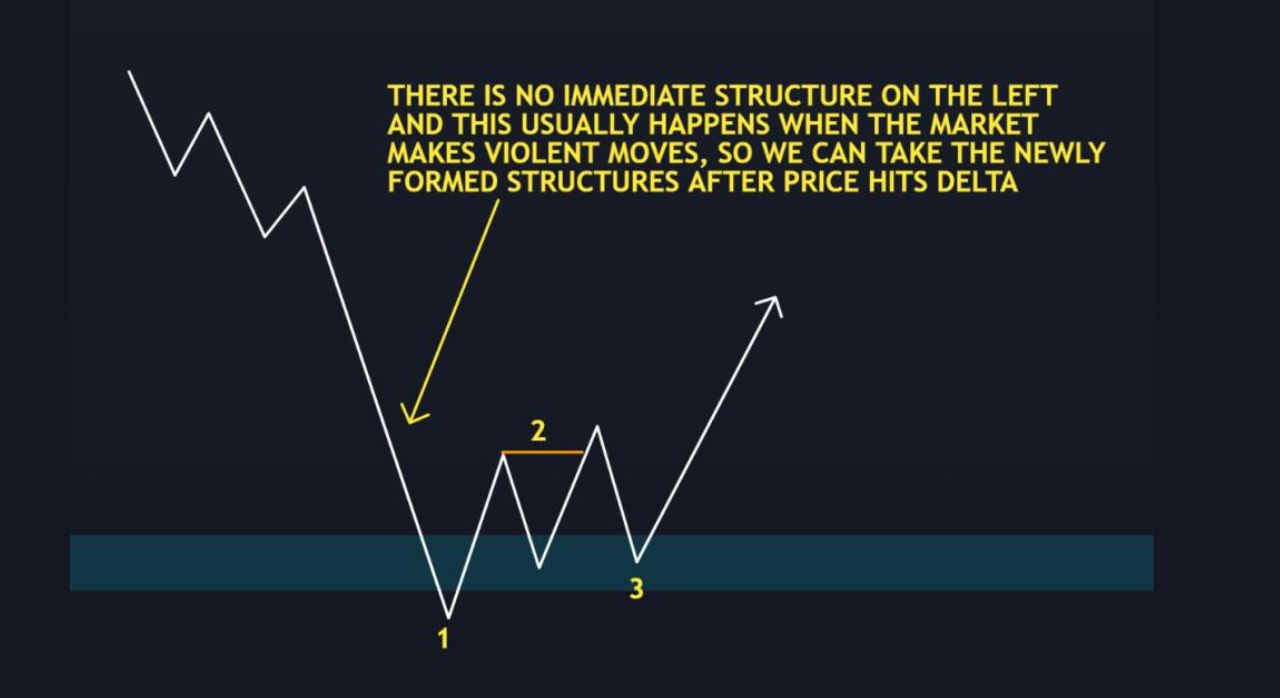

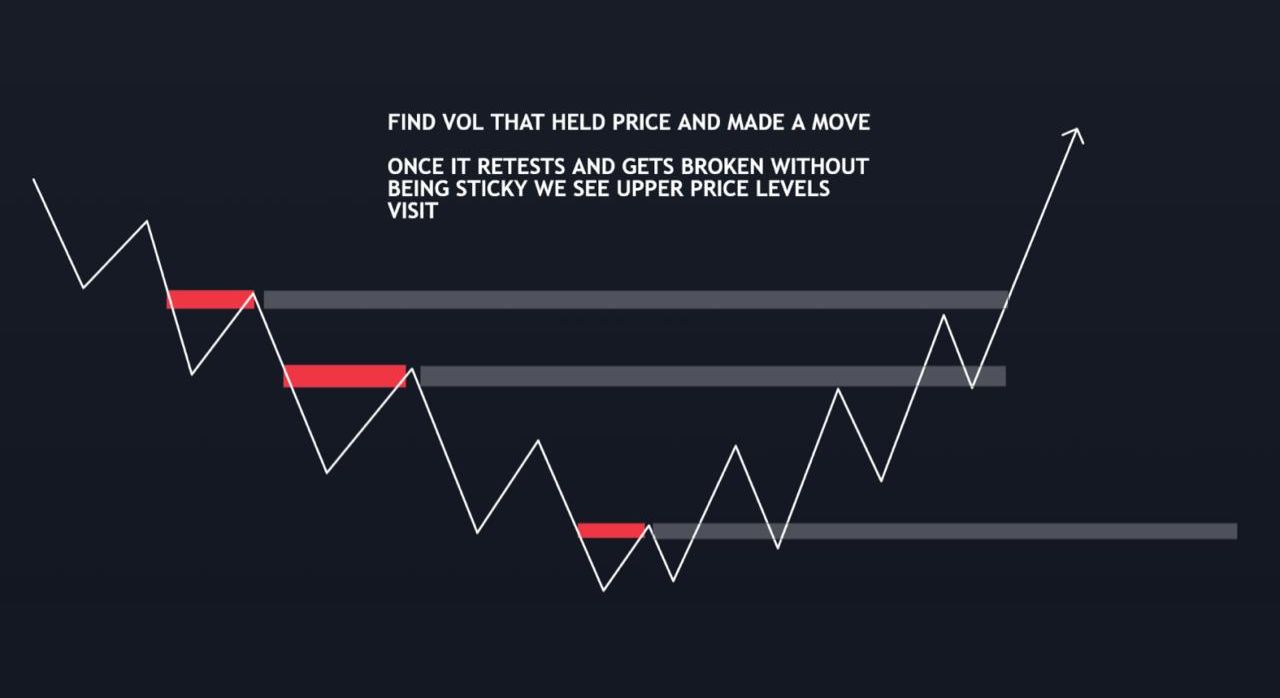

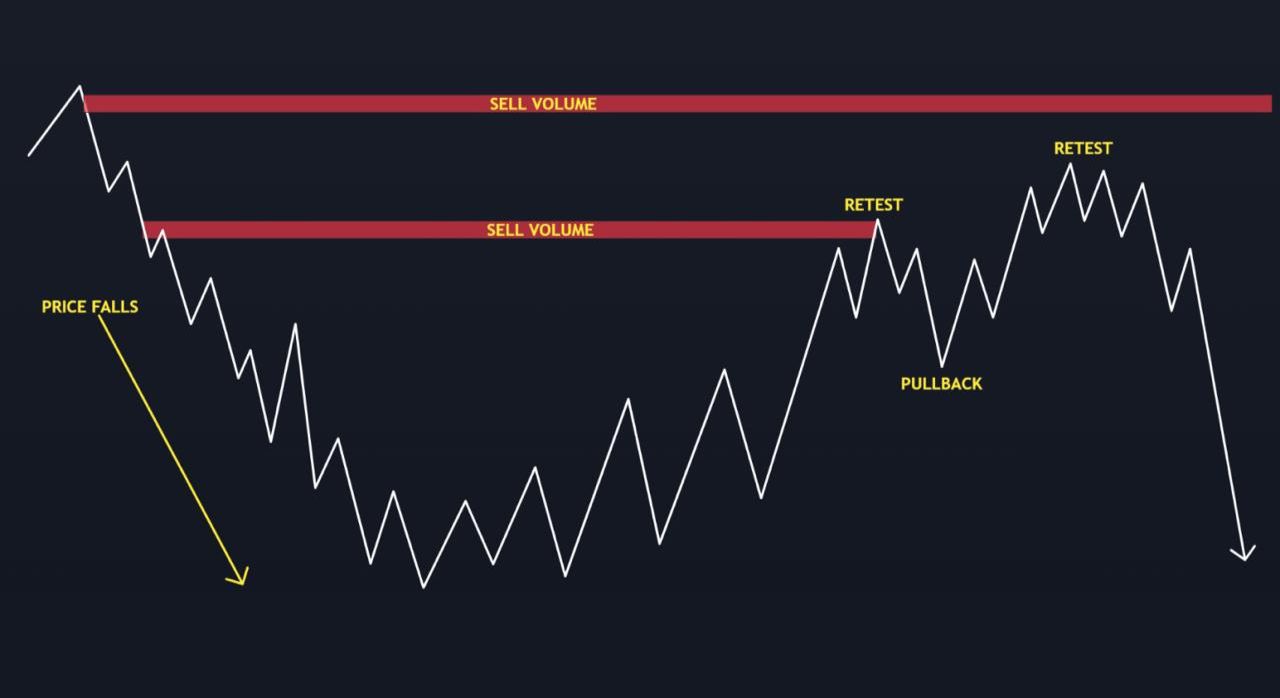

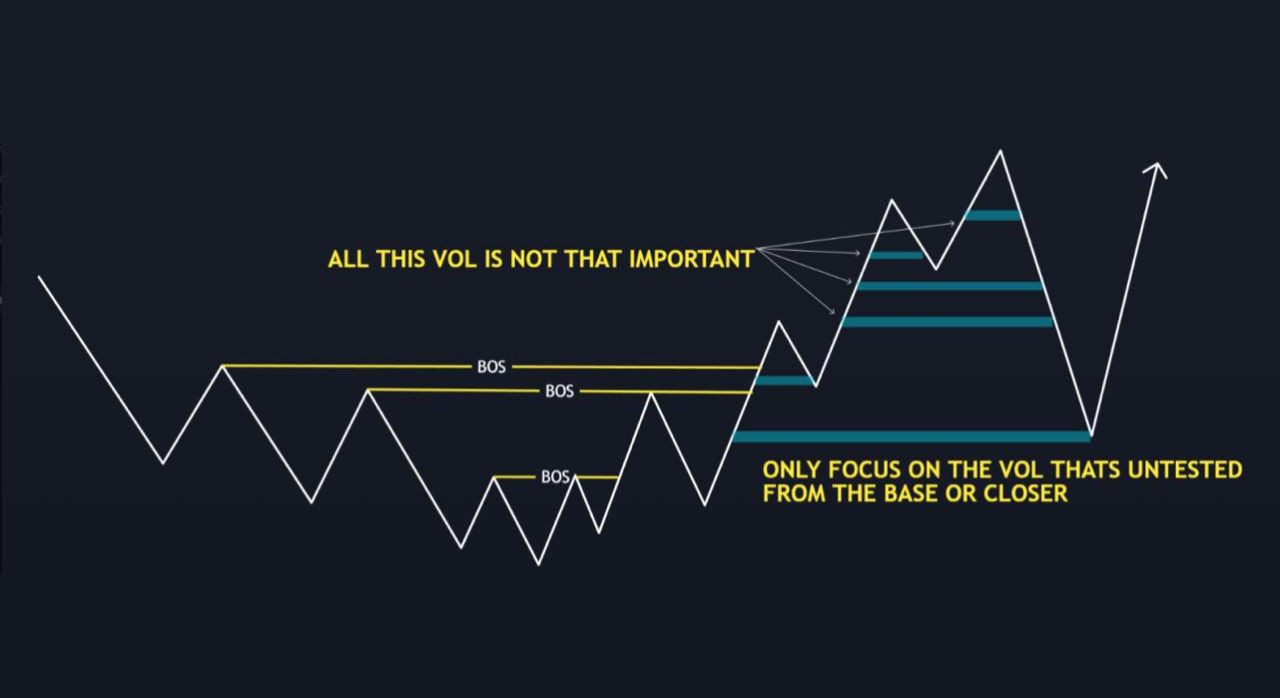

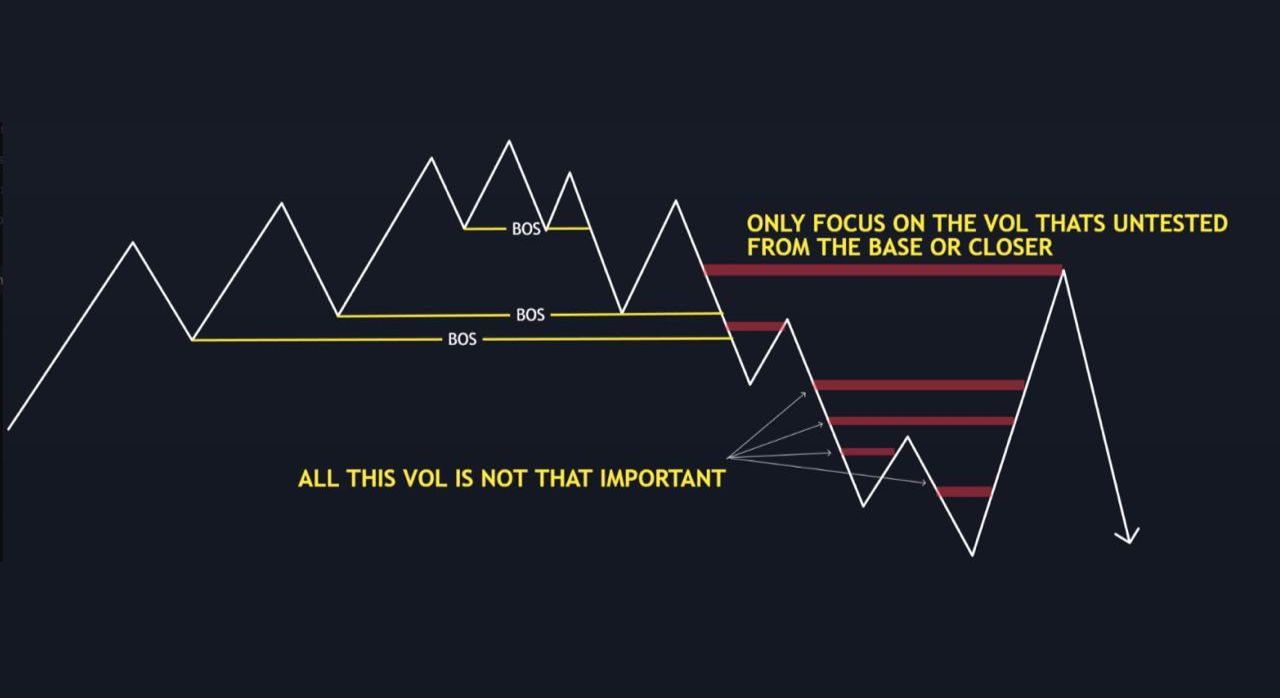

We don’t use market profiles in our analysis; instead, we use delta zones to align with order flow and price action

We do not use volume profiles in our analysis

Instead we use delta zones

Instead our liquidity is automatically calculated according to our filters to give us better signals

Become a Master of the Markets

How to Access

Secure Your Spot

Kickstart your trading journey by securing a spot in our renowned OrderFlow course. Visit our website, select the OrderFlow course from the offerings, and complete your purchase. Our straightforward checkout process ensures that you can quickly move from an aspiring trader to an active learner.

Join Our Community

Upon completing your purchase, you will receive an exclusive Discord link. This link grants you entry into our vibrant trading community led by a seasoned trader with 13 years of experience in the financial markets. Here, you will connect with other dedicated traders, all focused on mastering the art of order flow analysis.

Dive Into Learning

Gain full access to our comprehensive suite of course materials on Discord, where each resource is designed to transform your understanding and execution of trade strategies. From detailed instructional videos to live Q&A sessions, every aspect of the course is tailored to provide you with a deep, practical understanding of market dynamics.